- +91 9884234686

-

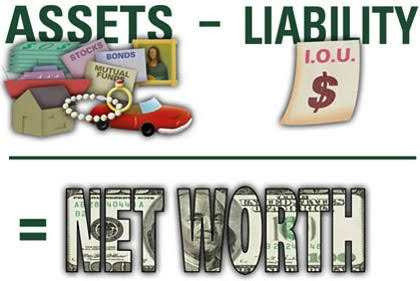

Net worth is the value of all the non-financial and financial assets owned by an institutional unit or sector minus the value of all its outstanding liabilities. Thus, net worth can refer to companies, individuals, or governments.

The below pictures explain you what is Net worth is all about…

In a layman language, anything that can be converted into cash is one’s net worth. Typically, individual net worth comprises of the following.

Across India, the highest percentage contributes none other than real estate investments, which is highly illiquid and it is purely depends on demand and supply. Yet, they neither worried about this nor they felt they were overexposed to one investment.

There is no regulator and largely influenced by the black money, after demonetization this sector hits very badly. In the next few years also hardly one can see any growth or meagre growth is only possible!

Some of my clients in the recent past are asking me all my investments are in mutual fund only, many feel that, am I taking a huge risk because everywhere it is mentioned that one should not put everything in a single investment, whereas am investing everything in MF! For them Mutual Fund is the investment and real estate is not looking at an investment angle which is eating away the biggest PIE.

If you look at the typical Indian investor investment distribution, hardly anything from mutual fund, so their mutual fund contribution to their net worth is insignificance.

Typical retail investor’s goals are long term in nature and they have to build brick by brick through power of compounding only, so no need to worry about it. Basically mutual fund suit all the retail investor needs, it gives highest form of liquidity, level playing field, no location specific, no volume game and on top of it is controlled by the regulator.

Nobody is there to guide any other investments, except mutual funds as far as India is concerned. Here is somebody (Advisor) who can guide the investor through all the volatile times and helps to realize investor goal by projecting what is possible based on the investment vehicle potential, not giving mere hope but reading the investment options better. This is the only investment, you happened to deal with professionals.

Unfortunately, we don’t like anything which is transparent in nature. Nobody likes 1+1=2 which is reality. Everyone likes 1+1 = !!! (Your imagination). This gives all the hope and thrill is the reason for still everyone is playing all the time on real estate!

Tags : ,

At Fortune Investment Services, we focus on our clients most critical issues and opportunities. We offer them the variety of investment avenues available, provide a walkthrough on the purpose of the investment vehicle and make sure we choose the right product suitable for client needs.

No: 30, L'Harmonie,

3rd floor, Bazullah Road,

T. Nagar, Chennai - 600017

Landmark: Opp. Kovai Pazhamudir Nilayam

Copyright © Fortune Investment Services. All rights reserved. |