- +91 9884234686

-

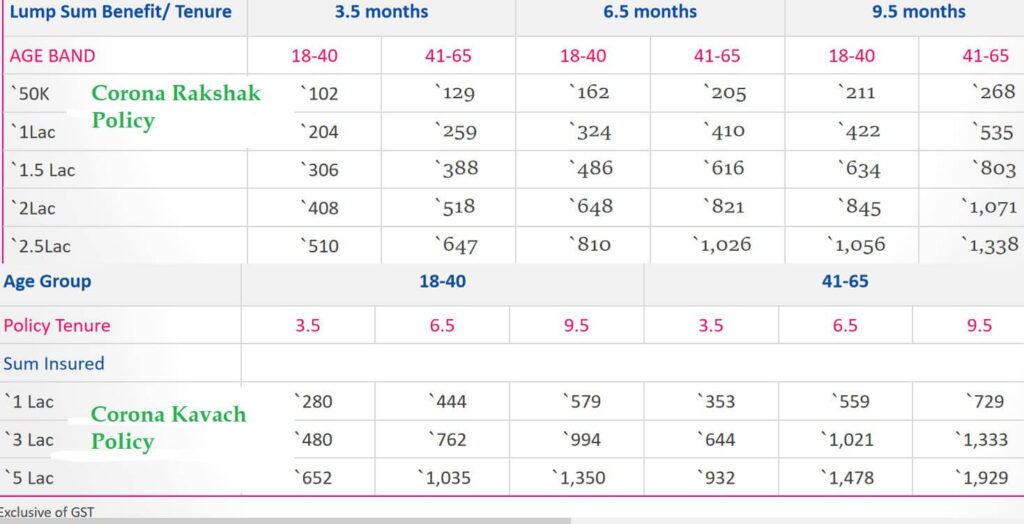

Corona Kavach & Rakshak

COVID-19 has given a very strong wake-up call to all of us that “Health Insurance is no more a ‘good-to have’ but rather a ‘must-have’ product”.

In view of this pandemic, to cater all types of people, IRDAI had instructed all the Insurers to come up with a standard COVID-specific policy – Corona Kavach & Corona Rakshak.

These are exclusively structured for corona and the maximum duration is 9.5 Months.

The biggest difference is, that in Corona Kavach Policy, only the hospital bill gets reimbursed to the tune of maximum 5 Lakhs cover, but in Corona Rakshak Policy, the 100 per cent of the sum insured is paid to the policyholder to the tune of maximum 2.5 Lakhs.

In Corona Kavach Policy, the base coverage or the sum insured will apply only when there is a hospitalization of a minimum period of 24 hours. The hospital expense up to the sum insured will be paid as claim by the insurer irrespective of the duration of stay in the hospital.

Corona Kavach policy will be an indemnity-based policy, but optional cover shall be made available on benefit basis. The base cover will offer hospitalization expenses like room and board charges along with PPE kits, gloves, masks [which may not be covered under traditional health plans covering corona, which actually mounts the expenses] and such other similar expenses and even alternative medical treatment like AYUSH.

Corona Kavach will also cover home care treatment expenses of up to 14 days, if it involves an active line of treatment and is done on a medical practitioner’s advice, with other conditions. Cost of pulse oximeter, oxygen cylinder and nebulizers will also be covered.

The Corona Kavach Policy gives one the option to add ‘Hospital Daily Cash’ cover. Under it, the insurer will pay 0.5 per cent of the sum insured per day for every 24 hours of continuous hospitalization for treatment of COVID following an admissible hospitalization claim under this policy. The benefit shall be payable maximum up to 15 days during a policy period.

“While Corona Kavach is an indemnity-based plan that reimburses policyholders based on medical expenses incurred for treating COVID, Corona Rakshak is a benefit plan that offers fixed compensation upon the patient being diagnosed with COVID and being hospitalized for 72 hours, irrespective of the medical expenses incurred.

For any assistance please call us Mr. Prabu 9884059068 and we are happy to serve you…

Tags : ,

At Fortune Investment Services, we focus on our clients most critical issues and opportunities. We offer them the variety of investment avenues available, provide a walkthrough on the purpose of the investment vehicle and make sure we choose the right product suitable for client needs.

No: 30, L'Harmonie,

3rd floor, Bazullah Road,

T. Nagar, Chennai - 600017

Landmark: Opp. Kovai Pazhamudir Nilayam

Copyright © Fortune Investment Services. All rights reserved. |